In addition to straight line depreciation, there are also other methods of calculating depreciation of an asset. Different methods of asset depreciation are used to more accurately reflect the depreciation and current value of an asset. A company may elect to use one depreciation method over another in order to gain tax or cash flow advantages. Compared to other depreciation methods, double-declining-balance depreciation results in a larger amount expensed in the earlier years as opposed to the later years of an asset’s useful life.

- This means more depreciation expense is recognized earlier in an asset’s useful life as that asset may be used heavier when it is newest.

- As can be seen from the example above, an asset will continue to have some residual value even after the depreciable amount has been deducted.

- Accounting depreciation (also known as a book depreciation) is the cost of a tangible asset allocated by a company over the useful life of the asset.

- The Internal Revenue Service specifies how certain assets will be depreciated for tax purposes.

- Businesses large and small employ depreciation, as do individual investors in assets such as rental real estate.

Work with your accountant to be sure you’re recording the correct depreciation for your tax return. Businesses have some control over how they depreciate their assets over time. Good small-business accounting software lets you record depreciation, but the process will probably still require manual calculations.

Depreciation Outline

The amortization base of an intangible asset is not reduced by the salvage value. This is often because intangible assets do not have a salvage, while physical goods (i.e. old cars can be sold for scrap, outdated buildings can still be occupied) may have residual value. In some jurisdictions, the tax authorities publish guides with detailed specifications of assets’ classes.

Land is not considered to lose value or be used up over time, so it is not subject to depreciation. Buildings, however, would be depreciated because they can lose value over time. The sum-of-the-years’-digits understanding quickbooks lists method (SYD) accelerates depreciation as well but less aggressively than the declining balance method. Annual depreciation is derived using the total of the number of years of the asset’s useful life.

What Is Depreciation and How Is It Calculated?

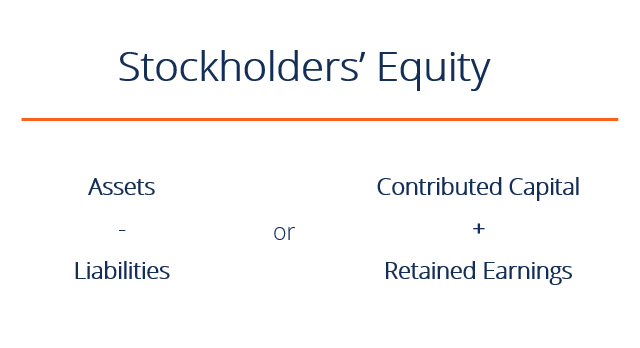

Depreciation expense is recorded on the income statement as an expense or debit, reducing net income. Accumulated depreciation is not recorded separately on the balance sheet. Instead, it’s recorded in a contra asset account as a credit, reducing the value of fixed assets.

To make the topic of Depreciation even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our depreciation cheat sheet, flashcards, quick tests, quick test with coaching, business forms, and more. At this point, the company has all the information it needs to calculate each year’s depreciation. It equals total depreciation ($45,000) divided by the useful life (15 years), or $3,000 per year.

Post an Integrated Asset Acquisition and Analyze the Value

If your business makes money from rental property, there are a few factors you need to take into account before depreciating its value. As a reminder, it’s a $10,000 asset, with a $500 salvage value, the recovery period is 10 years, and you can expect to get 100,000 hours of use out of it. Remember, the bouncy castle costs $10,000 and has a salvage value of $500, so its book value is $9,500. Its salvage value is $500, and the asset has a useful life of 10 years. Since the balance is closed at the end of each accounting year, the account Depreciation Expense will begin the next accounting year with a balance of $0.

These reconciliation accounts are assigned in supplier master records. Depletion is another way that the cost of business assets can be established in certain cases. For example, an oil well has a finite life before all of the oil is pumped out. Therefore, the oil well’s setup costs can be spread out over the predicted life of the well.

Note here that, if this number of years in use is equal to the product lifetime, the residual value is zero. We recommend Bookkeeping All-in-One for Dummies for those folks new to bookkeeping. It discusses depreciation and provides depreciation examples in many sections of the book, unlike the Accounting for Dummies manual (affiliate link). If you paid $120,000 for the property, then 75% of $120,000 is $90,000. If this information isn’t readily available, you can estimate the percentage that went toward the land versus the amount that went toward the building by looking at the taxable value. Play around with this SYD calculator to get a better sense of how it works.

Integrated Asset Acquisitions (with Accounts Payable)

With the double-declining-balance method, the depreciation factor is 2x that of the straight-line expense method. Depreciation expense is used in accounting to allocate the cost of a tangible asset over its useful life. In other words, it is the reduction in the value of an asset that occurs over time due to usage, wear and tear, or obsolescence. The four main depreciation methods mentioned above are explained in detail below.

For example, the asset class Machinery is linked to a different asset balance sheet account than the asset class Building. It had a useful life of three years over which it generated annual sales of $800. That means that the same amount is expensed in each period over the asset’s useful life. Assets that are expensed using the amortization method typically don’t have any resale or salvage value. Even though this isn’t the most accurate description of depreciation, it is often used due to its straightforwardness.

It is a tax accounting method by which an asset’s cost is allocated over the duration of its useful life using one of several generally accepted depreciation formulas. Accumulated depreciation is used to calculate an asset’s net book value, which is the value of an asset carried on the balance sheet. The formula for net book value is cost an asset minus accumulated depreciation. Let’s say that, according to the manufacturer, the bouncy castle can be used a total of 100,000 hours before its useful life is over. To get the depreciation cost of each hour, we divide the book value over the units of production expected from the asset.

What Is Depreciated Cost?

A company estimates an asset’s useful life and salvage value (scrap value) at the end of its life. Depreciation determined by this method must be expensed in each year of the asset’s estimated lifespan. Continuing with our example above, the company will add back the yearly depreciation amount of $20,000 to the cash flow statement under the operating activities section. However, the initial investment will reflect the cash outflow in the investing activity section of the cash flow statement. Further, the company uses a simple straight-line depreciation method. For simplicity, let’s assume the equipment’s salvage value will be zero after ten years.